Table Of Content

- How current mortgage rates affect your mortgage payments

- Compare current mortgage rates by loan type

- Current 30-year mortgage rates are averaging 7.52%. The average rate for 30-year fixed mortgage refinance is 7.76%.*

- What is a mortgage rate lock?

- HomeServices Becomes Final Brokerage To Settle Real Estate Agent Fee Lawsuit

Most home loans require at least 3% of the price of the home as a down payment. Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

How current mortgage rates affect your mortgage payments

She holds a degree in journalism from the University of North Texas. When she’s not working on finance-related content, Caroline enjoys baseball, traveling and going to concerts. “[W]ith rates remaining elevated, there is very little incentive right now for rate/term refinances,” said Joel Kan, vice president and deputy chief economist at MBA, in a press statement. “If rates are lower than when you first got your mortgage, it might be a favorable time,” says Vernon. However, whether rates go lower in 2024 will depend, in part, on economic conditions. The Fed’s latest summary of economic projections maintained the three planned rate cuts for 2024, but Federal Reserve Chair Jerome Powell reiterated the timing of those rate cuts will depend on more inflation data.

Compare current mortgage rates by loan type

This is in part because banks anticipate the decreased purchasing power of the interest earned during periods of high inflation. Caroline Basile is Forbes Advisor’s student loans and mortgages deputy editor. With experience in both the mortgage industry and as a journalist, she was previously an editor with HousingWire, where she produced daily news and feature stories.

Current 30-year mortgage rates are averaging 7.52%. The average rate for 30-year fixed mortgage refinance is 7.76%.*

Ultimately, a more affordable mortgage market will depend on how quickly the Fed begins cutting interest rates. Most economists predict that the Fed will start lowering interest rates later this summer. Rene Bermudez is a staff writer at LendingTree, where she covers mortgages and personal finance. She researches both current and historical trends in the mortgage industry in order to give the best analysis and guidance to readers grappling with these complex financial products. Mortgage rates can change daily and can even rise or fall hourly. If you see rates that work with your finances, get a rate lock from your lender so you don’t lose access to that interest rate in the time it takes to find your dream home and close on your loan.

For mortgage pre-approval, the lender reviews your credit history and financial situation and verifies your income. Pre-approvals aren't always a firm commitment to lend, but generally, if nothing in your financial situation or credit history changes, there's a good chance you'll get a green light when you apply. The average rate on a 30-year mortgage has now increased four weeks in a row. The latest uptick brings it to its highest level since November 30, when it was 7.22%. Our experts have been helping you master your money for over four decades.

What is a mortgage rate lock?

So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate. The APR is the total cost of your loan, which is the best number to look at when you’re comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders (with higher rates and lower fees), so you’ll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate. I’ve covered the housing market, mortgages and real estate for the past 12 years. At Bankrate, my areas of focus include first-time homebuyers and mortgage rate trends, and I’m especially interested in the housing needs of baby boomers.

US Mortgage Rates: Mortgage Rates by State - Business Insider

US Mortgage Rates: Mortgage Rates by State.

Posted: Thu, 25 Apr 2024 21:24:00 GMT [source]

Whether or not 2024 will be a good time to refinance depends on several factors, including if the Fed cuts interest rates this year and by how much. The mortgage rate you got when you financed your home is another major factor. Over the past two years, mortgage rates have skyrocketed to their highest levels in decades amid the Fed’s efforts to tame inflation through aggressive interest rate policy actions. Rates have recently begun to recede—albeit sluggishly—due partly to the Fed’s rate-hike pauses. Rates on unusually small mortgages — a $50,000 home loan, for example — tend to be higher than average rates because these loans are less profitable to the mortgage lender. Discount points can provide a lower interest rate in exchange for paying cash upfront.

Mortgage options and terminology

The most important task for a prospective homeowner seeking a preapproval letter is to gather all the financial paperwork needed to give the lender a solid picture of your income, debts and credit history. This information helps underwriters estimate how much of a loan you can afford and the costs of the loan. If you don’t lock in right away, a mortgage lender might give you a period of time—such as 30 days—to request a lock, or you might be able to wait until just before closing on the home. While rates remain elevated, the Fed signaled that it will begin to cut rates in 2024, indicating a further downward shift in mortgage rates may soon come. To help you find the right one for your needs, use this tool to compare lenders based on a variety of factors. Bankrate has reviewed and partners with these lenders, and the two lenders shown first have the highest combined Bankrate Score and customer ratings.

Are 30-year fixed mortgage rates going down?

A credit score of 620 or higher might qualify you for a conventional loan, and — depending on your down payment and other factors — potentially a lower rate. The type of mortgage loan you use will affect your interest rate. If possible, give yourself a few months or even a year to improve your credit score before borrowing. You could save thousands of dollars through the life of the loan.

Estimated monthly payments shown include principal, interest and (if applicable) any required mortgage insurance. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a 10y/6m ARM). Select the About ARM rates link for important information, including estimated payments and rate adjustments.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Refinance rates valid as of and assume borrower has excellent credit (including a credit score of 740 or higher).

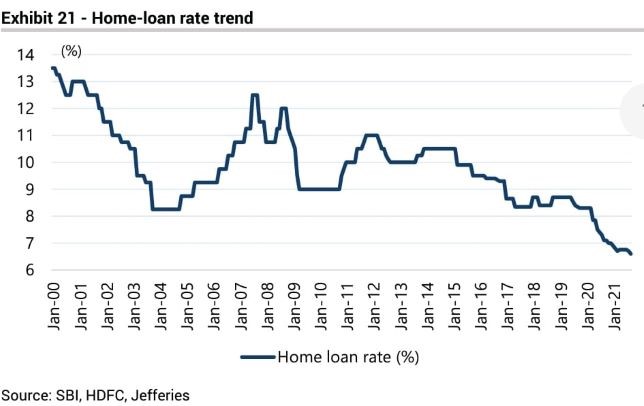

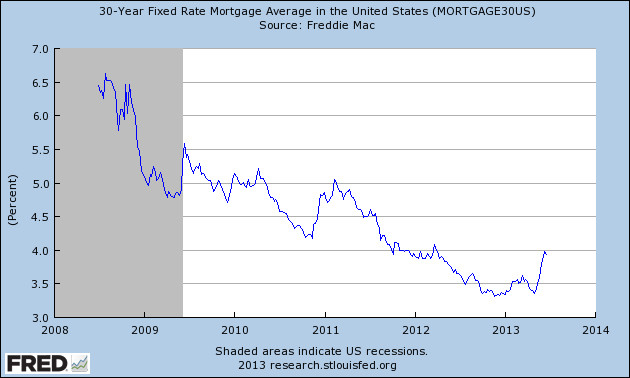

Remember that average mortgage rates are only a general benchmark. If you have good credit and strong personal finances, there’s a good chance you’ll get a lower rate than what you see in the news. Rates plummeted in 2020 and 2021 in response to the Coronavirus pandemic. By July 2020, the 30-year fixed rate fell below 3% for the first time.

Current HELOC rates are relatively low compared to other loan options, including credit cards and personal loans. This week's average 30-year fixed mortgage rate was 7.17%, according to Freddie Mac. It's still early in the year, and there will be many inflation reports released between now and September, when investors believe the Fed might finally start cutting rates.

However, those rates are subject to change after the initial fixed-rate period. An initially low ARM rate could rise substantially after 5, 7, or 10 years. Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means.

Thanks to sharp inflation growth, higher benchmark rates, and a drawback on mortgage stimulus by the Fed, mortgage rates spiked in 2022. With Federal Reserve voting to hold the federal funds rate steady in January and inflation heading closer to target, three rate cuts appear to be on the menu in 2024. This would be the first cut since the Fed slashed rates in the early days of the Covid-19 pandemic, although most experts don’t expect to see it happening until some point in the spring. “We are expecting mortgage rates to fall to around 6.5% by the end of this year, but there’s still a lot of volatility I think we might see,” said Daryl Fairweather, chief economist at Redfin. Mortgage forecasters base their projections on different data, but most housing market experts predict rates will move toward 6% by the end of 2024.

No comments:

Post a Comment